Displaying items by tag: Cryptocurrencies

SICP ANNOUNCED THE LAUNCH OF CRYPTOCERT

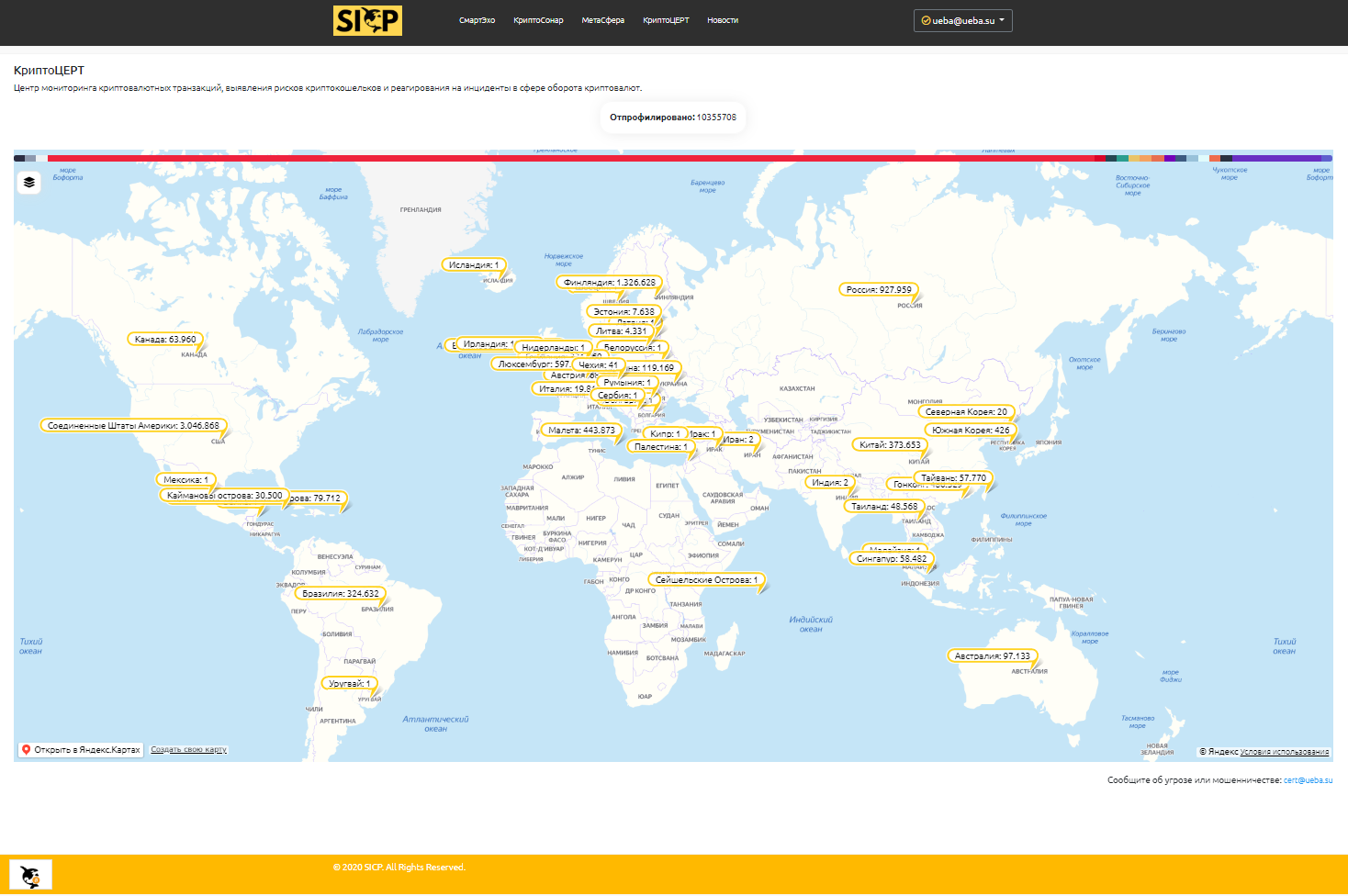

On July 30, the SICP (Security Intelligence Cryptocurrencies Platform) platform announced the launch of the first Russian commercial Center for monitoring cryptocurrency transactions, identifying the risks of cryptocurrency wallets and responding to incidents in the field of cryptocurrency circulation (CryptoCERT).

This service is the first in Russia and the UIS. Today, any citizen or organization can send information about fraud (another threat or risk) related to cryptocurrencies. Additionally, the publicly available interactive map displays profiled crypto wallets by country. The custom menu allows you to display one or more profiles. The legend displays the share and number of wallets associated with the profile. For registered and verified users, a wider visualization functionality is available.

It should be noted that on July 22, the State Duma of the Russian Federation adopted in the 3rd reading the law "On digital financial assets". The new rules will enter into force on January 1, 2021. The law "On digital currency" is expected to be considered in the coming autumn.

Remarkably, today is World Day Against Trafficking in Persons. It is a serious crime and gross violation of human rights. The United Nations Office on Drugs and Crime (UNODC), as the guarantor of the United Nations Convention against Transnational Organized Crime and the Protocols thereto, assists States in their efforts to implement the Trafficking in Persons Protocol.

By the way, this factor is taken into account when assessing the risks of crypto wallets, in the SmartEcho service, and identifying suspicious transactions ...

Source: sicp.ueba.su

Source: k4y0t.ru

SEC STATEMENT ON “FRAMEWORK FOR INVESTMENT CONTRACT ANALYSIS OF DIGITAL ASSETS”

April 3, 2019. Public Statement. Bill Hinman, Director of Division of Corporation Finance; Valerie Szczepanik, Senior Advisor for Digital Assets and Innovation.

Blockchain and distributed ledger technology can catalyze a wide range of innovation. They have seen these technologies used to create financial instruments, sometimes in the form of tokens or coins that can provide investment opportunities like those offered through more traditional forms of securities. Depending on the nature of the digital asset, including what rights it purports to convey and how it is offered and sold, it may fall within the definition of a security under the U.S. federal securities laws.

As part of a continuing effort to assist those seeking to comply with the U.S. federal securities laws, FinHub is publishing a framework for analyzing whether a digital asset is offered and sold as an investment contract, and, therefore, is a security. The framework is not intended to be an exhaustive overview of the law, but rather, an analytical tool to help market participants assess whether the federal securities laws apply to the offer, sale, or resale of a particular digital asset. Also, the Division of Corporation Finance is issuing a response to a no-action request, indicating that the Division will not recommend enforcement action to the Commission if the digital asset described in the request is offered or sold without registration under the U.S. federal securities laws.

This framework represents Staff views and is not a rule, regulation, or statement of the Commission. The Commission has neither approved nor disapproved its content. This framework, like other Staff guidance, is not binding on the Divisions or the Commission. It does not constitute legal advice, for which you should consult with your own attorney. It does not modify or replace any existing applicable laws, regulations, or rules. Market participants are encouraged to review all the materials published on FinHub...

Source: SEC.gov

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su