Блог

CRYPTO INSOLVENCY: 10 THINGS EVERY DIRECTOR OF A CRYPTO FIRM NEEDS TO KNOW WHEN THINGS START TO GO WRONG

Written by Manuylova NatalyaFebruary 2019, while the crypto ecosystem continues to make considerable progress in building out its infrastructure and 'institutionalising' the space, many crypto players are facing challenges due to a broad range of issues, from a fall in cryptoasset prices to more regular start-up challenges.

This is forcing many crypto firms into situations of financial distress. In this article, they set out the ten things that any director or senior executive of a crypto entity needs to know when its solvency status is in doubt.

Download Crypto Insolvency...

INITIAL COIN OFFERINGS (ICO'S) FOR SME FINANCING

Written by Aleksandr Podobnykh15 January 2019 - Initial Coin Offerings (ICOs) are one of the most prominent applications of blockchain for finance, allowing for an innovative and inclusive way of financing small and medium-sized enterprises (SMEs).

Although the lack of regulatory clarity currently exposes ICO participants to some risks, appropriately regulated and supervised ICOs offer a potential new way to raise capital for projects enabled by Distributed Ledger Technologies and the blockchain.

This report analyses the emergence and potential of ICOs as a financing mechanism for start-ups and SMEs, examines the benefits and challenges of this mechanism for small businesses and investors, and discusses the policy implications of ICO activity for the inclusive financing of SMEs and the real economy...

Source: OECD.

SAFETY AND SECURIT COMMITTEE TALKS ABOUT PREVENTING BUSINESS RISKS, ACCESS CONTROL OPTIONS AND CRYPTOCURRENCY RELATER CRIME

Written by Aleksandr PodobnykhFebruary 14, 2019. AmCham SPb News and Events...

The meeting featured three presentations by Igor Bederov, Internet-Rozysk, Yuri Ivanov, Hyundai Motors and by Alexander Podobnykh, SICP and convened around 20 security specialists from member companies.

Presentations:

1. Risks prevention at the first contact stage. What can contact details reveal? (in Russian).

2. Access control and access management systems: new technologies in security provision (in Russian).

3. Prevention and investigation of crypto currency turnover related crime (in Russian).

Source: AmCham Russia.

CRYPTO CRIME REPORT: DECODING HACKS, DARKNET MARKETS, AND SCAMS

Written by Bederov IgorReleased today, Chainalysis latest crypto crime research on $1.6B in hacks, darknet market activity, and Ethereum scams shows how they decoded each type of crime and what it means for AML compliance and investigations.

Crypto crime increased in 2018, but it made up a smaller slice of a much larger market. Indeed, according to they analysis, illicit transactions comprised less than 1% of all economic bitcoin activity in 2018, down from 7% in 2012.

Even so, crime remains a significant problem in the cryptocurrency ecosystem. Exchange hacks have generated billions of dollars in criminal proceeds, darknet market activities have netted hundreds of millions of dollars in illicit revenues, and scams targeting individuals have stolen tens of millions of dollars.

Moreover, criminal use of cryptocurrencies has become far more sophisticated. As a result, in this second edition of their Crypto Crime Report, they go deeper in analysis to seek out granular insight into three categories of criminal activity.

Then, they examine the surprising resilience of darknet markets as law enforcement takes aggressive action against them. In a report on the “whack-a-mole” problem with the darknet, they look at how transaction activity briefly subsides then quickly reroutes itself to new platforms when major darknet markets are closed down.

They also examine changing trends in Ethereum scams, where individuals are targeted, as last year’s phishing schemes lose their effectiveness and more complex Ponzi and ICO exit scams emerge to make outsized gains.

Finally, they discuss the role of cryptocurrency in the broader context of money laundering and highlight the importance of different types of services that are used to integrate illicit cryptocurrency into the clean economy...

Source: Chainalysis Research.

BLOCKCHAIN TECHNOLOGY DIGEST: JANUARY 2019

Written by Aleksandr PodobnykhMind Smith has prepared an overview of key materials, analytical reports, research, reports and research articles. All the most interesting in the industry for the month...

37 analytical studies and reports, 27 scientific articles, 5 documents of international organizations.

Since 2018, Mind Smith has been implementing strategic blockchain consulting. Helps answer the question about the use of technology blockchain in business, conducts research and strategic sessions for top managers.

The company believes in the blockchain technology, but understand its limitations. For effective implementation of a well-coordinated work of the business and technical team. Mind Smith is ready to go all the way from the search for possible scenarios and the preparation of the concept to the implementation of the pilot and the implementation of the solution in the business.

IN 2 MONTHS SICP REVEALED 46.000 "UNRELIABLE" BITCOIN WALLETS

Written by Bederov IgorIn Russia, announced an online service that analyzes the risks of using cryptocurrency and investigates crimes committed in this area. The development was carried out by the company "Internet-Rozysk".

The service, which was launched last year, was called the Security Intelligence Cryptocurrencies Platform. In January, an alpha version of the service appeared on the site www.ueba.su.

According to the project director Igor Bederov, the service was launched in December last year and as of January 2019, he found 46 thousand bitcoin wallets, which were given the status of "unreliable".

SICP analyzes blockchains, websites, chat rooms, and forums to identify those cyberwiches that are used in criminal schemes, such as fraud, blackmail, money laundering, and so on. Also, the development team of the platform builds interactions with market participants, public organizations and law enforcement agencies. One of the promising goals of the service creators see deanonymization of purses and assigning them the status of “trustworthy” - provided that they are not seen in the implementation of suspicious operations, and “unreliable” - if the operations that were carried out through the wallet raise doubts. At this stage, the strategic partners of the project are CipherTrace, Sentinel Protocol, Crystal, CryptoPolice, Wawes, SPb BlockChain, CryptoRussia.ru and ACISO.

The developers set themselves the task of giving users the ability to track all transactions from the moment they are sent until the moment they receive funds on the recipient’s wallet. The system should work by analogy with the methods that are now used by the financial supervision authorities. The service will identify wallets that are used for money laundering, terrorist financing and other illegal purposes. Also, the service will be able to monitor transactions on certain wallets for a long time, which will allow detecting fraudulent ICOs.

SICP is a breakthrough technology for Russian crypto-business. This prominent development will allow participants of the Russian cryptocurrency market to protect themselves from fraud, journalists said.

Note that on pre-sale, SICP tokens can be purchased at half price, and the alpha version of the service from January 9 can be connected to www.ueba.su.

Source: CryptoRussia.ru

We are proud to present the single, most comprehensive data-driven analysis on European technology today.

What’s changed for European tech in the past 12 months? It’s been another record year for investment in European tech and the sector is powering growth in Europe’s stagnant economy. Yet not everyone is benefitting from the boom. The gains are not being democratized by investors. Companies need to address diversity and inclusion tools and unlock hidden talent pools.

This is the fourth edition of the State of European Tech report, the single, most comprehensive data-driven story of European technology today. We’ve gathered data from world-class data partners and a survey of 5,000 members of the tech ecosystem, from founders to students, investors to researchers. We’ve tried to tell the most important stories. We cover diversity and inclusion, talent, regulation, investment, research and development, and the great, global disrupters out of Europe...

Source: State of European Tech 2018.

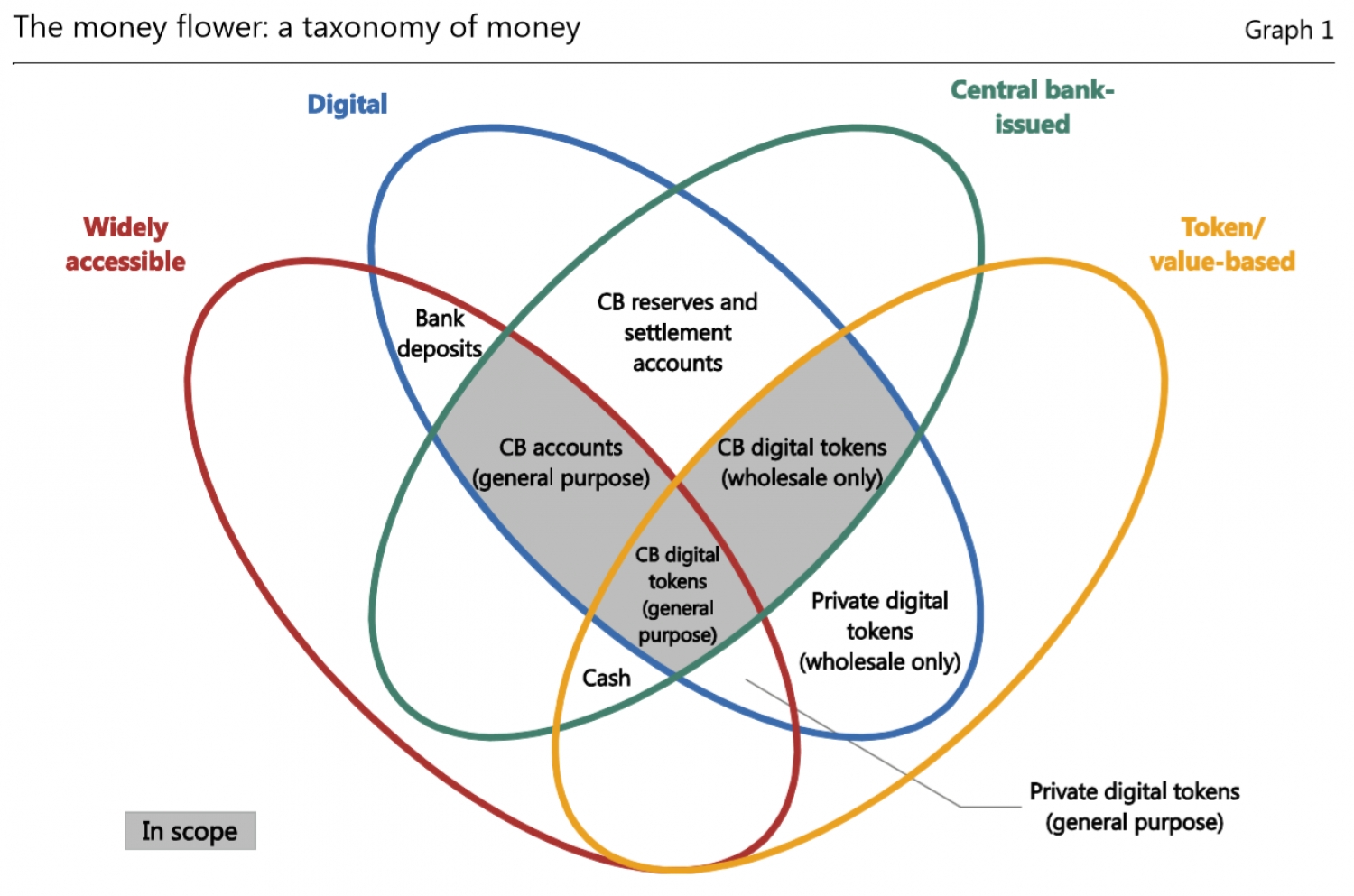

PROCEEDING WITH CAUTION - A SURVEY ON CENTRAL BANK DIGITAL CURRENCY: BIS

Written by Aleksandr PodobnykhOn January 8, Bank For International Settlements released BIS Papers № 101, written by By Christian Barontini and Henry Holden.

The hypothetical benefits and risks of central bank digital currencies are being widely discussed. This BIS paper adds to these discussions by taking stock of how progress and plans in this area are developing, based on a global survey of central banks. Responses show that central banks are proceeding with caution and most are only at a conceptual stage with their work. However, a handful have moved to considering practical issues and a couple of central banks with idiosyncratic circumstances might issue a digital currency in the short or medium term.

Source: Bank for International Settlements.

More...

UNITED KINGDOM'S MEASURES TO COMBAT MONEY LAUNDERING AND TERRORIST FINANCING

Written by Aleksandr PodobnykhParis, 7 December 2018 - The United Kingdom has a well-developed and robust regime to effectively combat money laundering and terrorist financing. However, it needs to strengthen its supervision, and increase the resources of its financial intelligence unit.

The FATF has conducted an assessment of the United Kingdom’s anti-money laundering and counter terrorist financing (AML/CFT) system. The assessment is a comprehensive review of the effectiveness of the UK’s measures and their level of compliance with the FATF Recommendations.

The UK is the largest financial services provider in the world. As a result of the exceptionally large volume of funds that flows through its financial sector, the country also faces a significant risk that some of these funds have links to crime and terrorism. This is reflected in the country’s strong understanding of these risks, as well as national AML/CFT policies, strategies and proactive initiatives to address them.

The UK aggressively pursues money laundering and terrorist financing investigations and prosecutions, achieving 1400 convictions each year for money laundering. UK law enforcement authorities have powerful tools to obtain beneficial ownership and other information, including through effective public-private partnerships, and make good use of this information in their investigations. However, the UK financial intelligence unit needs a substantial increase in its resources and the suspicious activity reporting regime needs to be modernised and reformed.

The country is a global leader in promoting corporate transparency and it is using the results of its risk assessment to further strengthen the reporting and registration of corporate structures. Financial institutions as well as all designated non-financial businesses and professions such as lawyers, accountants and real estate agents are subject to comprehensive AML/CFT requirements. Strong features of the system include the outreach activities conducted by supervisors and the measures to prevent criminals or their associates from being professionally accredited or controlling a financial institution. However, the intensity of supervision is not consistent across all of these sectors and UK needs to ensure that supervision of all entities is fully in line with the significant risks the UK faces.

The UK has been highly effective in investigating, prosecuting and convicting a range of terrorist financing activity and has taken a leading role in designating terrorists at the UN and EU level. The UK is also promoting global implementation of proliferation-related targeted financial sanctions, as well as achieving a high level of effectiveness in implementing targeted financial sanctions domestically.

The UK’s overall AML/CFT regime is effective in many respects. It needs to address certain areas of weakness, such as supervision and the reporting and investigation of suspicious transactions. However, the country has demonstrated a robust level of understanding of its risks, a range of proactive measures and initiatives to counter the significant risks identified and plays a leading role in promoting global effective implementation of AML/CFT measures.

FATF adopted this report at its Plenary meeting in October 2018...

BELGIAN AUTHORITIES UPDATE BLOCKCHAIN BLACKLIST

Written by Bederov IgorThe Belgian Financial Services and Markets Authority (FSMA) has updated their ongoing list of businesses reported to operate cryptocurrency scams. With this most recent addition of 14 websites the “blockchain blacklist” has now expanded to 113 websites to avoid.

The FSMA has been updating their blacklist throughout 2018. In March, the Brussels Times reported that Belgian tax authorities had started hunting for cryptocurrency investors. “Anyone speculating on the cryptocurrency market must pay tax of 33% on gains made, and declare these within the section ‘miscellaneous income’ on their tax return,” the Times reported.

Despite warnings from the FSMA consumers continue to log complaints regarding fraudulent activity on cryptocurrency exchanges. The FMSA has warned consumers to look out for various red flags. FSMA warns...

Source: Bitcoin, Ethereum and Blockchain News | CryptoGlobe.

The leading information security portal SecurityLab.ru has published a note: CipherTrace - audit trail encryption (2018/12/16).

For the first 9 months of 2018, theft in the cryptocurrency industry reached about $ 1 billion...

The October report by CipherTrace shows that the criminals used bitcoin to launder $ 2.5 billion of dirty money. Thus, 380 000 BTC was laundered on cryptocurrency exchanges.

A new study showed that 97% of criminal bitcoins flow into unregulated cryptocurrency exchanges.

Bitcoin's anonymity is a stumbling block for many, almost from the day it appeared. Despite the fact that a number of politicians and experts consider the first digital money to be completely anonymous, yet this is not true. To make a bitcoin transaction, you do not need personal data and the user's address, but information about all operations remains in the public distributed registry. This may allow you to track cash flow.

There are measures that can increase the anonymity of translations. For these purposes, services have been developed - cryptocurrency mixers. For example, you can convert Bitcoin to other cryptocurrencies, and then back. However, even such methods do not make the first cryptocurrency completely confidential. Both the sender and receiver can still be calculated.

It is noteworthy that at the moment, many state and commercial companies have attended to the identification of users. They make a lot of effort to master the methods of computing the identities of those who make suspicious transfers. Therefore, it’s impossible to talk about complete anonymity on the Bitcoin network...

Source: SecurityLab.ru

Source: K4Y0T Project.

Blockchain, a revolutionary basis for decentralized online transactions, carries security risks. Learn about current security problems and specific incidents within blockchain implementations, and the techniques, targets, and malware used for attacks.

What spiked the movement, starting in fall 2017, toward cryptojacking? The first reason is the value of cryptocurrency. If attacker can steal Bitcoins, for example, from a victim’s system, that’s enough. If direct theft is not possible, why not mine coins using a large number of hijacked systems. There’s no need to pay for hardware, electricity, or CPU cycles; it’s an easy way for criminals to earn money. We once thought that CPUs in routers and video-recording devices were useless for mining, but default or missing passwords wipe away this view. If an attacker can hijack enough systems, mining in high volume can be profitable. Not only individuals struggle with protecting against these attacks; companies suffer from them as well...

Search

Blog Category

Popular Post

Latest News

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su