Блог

ЗАКРЫТЫЙ КРУГЛЫЙ СТОЛ ПО NFT В МОСКОВСКОЙ ТОРГОВО-ПРОМЫШЛЕННОЙ ПАЛАТЕ

25 февраля, Комитет по культуре московской торгово-промышленной палаты и ООО «ОМ Групп» проводит встречу на тему: «Культура и современные технологии NFT. NFT угрозы и обеспечение безопасности», в период с 11:00 до 14:00.

Участники Круглого стола: модератор — Гнездилова Марианна Геннадьевна (руководитель комитета по культуре МТПП), приветственное слово — Крутова Александра Александровича (вице-президента МТПП).

Эксперт платформы КОСАтка Наталья Мануйлова (судебный эксперт, ведущий аналитик НИЦ РСВТ РТУ МИРЭА) примет участие в обсуждении вопросов возможностей и угроз NFT. Другие выступающие:

- Михалишин Андрей (CEO Joys)

- Петров Валерий (вице-президент РАКИБ)

- Макаров Руслан (ректор Института цифровой экономики)

- Привезенцев Максим (писатель, создатель литературного NFT в России, владелец Cigar Coin)

- Лакоценин Дмитрий Васильевич (Министерство Культуры РФ, отдел контроля за оборотом и сохранением культурных ценностей Департамент музеев и внешних связей)

- Мишедченко Ольга (генеральный директор ООО «ОМ ГРУПП»)

- Авдеев Михаил (Росбанк art-banking и NFT - art)

- Герберт Шопник (основатель Digital Art EXPO и телеграм-канала Digital ART & NFT)

КОНФЕРЕНЦИЯ РОССИЙСКОЕ КОРПОРАТИВНОЕ СТРАХОВАНИЕ И УРЕГУЛИРОВАНИЕ УБЫТКОВ ОТ КСК

Клуб Страховых Конференций приглашает принять участие в конференции Российское корпоративное страхование и урегулирование убытков, которая состоится 14 февраля 2022 года в AZIMUT Hotel Olympic Moscow.

Вот некоторые из тем презентаций конференции:

- формирование и выбор страхового покрытия, как заставить страховые компании предложить справедливую страховую премию за риски;

- управление рисками и страхование, как единая система, обеспечивающая достижения бизнес-целей;

- Digital решения в страховании;

- новые страховые продукты;

- особенности страхования во время пандемии;

- страхование кредитных рисков;

- нюансы страхования кибер-рисков;

- полисы D&O как защита интересов руководителей компании, страхователя, акционеров, третьих лиц;

- страхование экспедитора, особенности и нюансы;

- урегулирование сложных страховых случаев, нюансы и особенности, как заставить страховую компанию выплатить адекватное страховое возмещение.

Справки о конференции по тлф.: +7-916-601-0202, заявки на регистрацию направляйте на This email address is being protected from spambots. You need JavaScript enabled to view it. (фио, компания,корпоративный электронный адрес, должность, телефон для смс).

Источник: Клуб Страховых Конференций

МЕЖДУНАРОДНАЯ ВСТРЕЧА ЭКСПЕРТОВ РОССИИ И ШВЕЙЦАРИИ ПО ВОПРОСАМ ПРАВОВОГО РЕГУЛИРОВАНИЯ ЦФА

Эксперт платформы КОСАтка Наталья Мануйлова в качестве спикера примет участие в мероприятии: "Вопросы правового регулирования обращения цифровых финансовых активов в России и Швейцарии". Передовой опыт швейцарской финансовой системы, трансграничное правовое регулирование и комплаенс в сфере криптоактивов, а также риски и налоговые последствия для российских клиентов при совершении сделок в этой сфере.

Московская ТПП приглашает обсудить на организованной ими онлайн-конференции, 9 декабря 2021 года с 16:00 до 18:00 (Москва), 14:00-16:00 (Цюрих) на платформе ZOOM, среди спикеров:

- Марк Дамбахер, Генеральный директор InСore Bank (Швейцария);

- Филипп Майер, Руководитель подразделения крипто и цифровых активов Gazprombank Switzerland (Швейцария);

- Екатерина Энтони, Finvestech GmbH, член Совета директоров Crypto Valley Association (Швейцария);

- Дмитрий Кириллов, адвокат, юридическая фирма Lidings (Россия).

Мероприятие бесплатное, при условии предварительной регистрации. Пройдет на русском и английском языках с синхронным переводом.

Партнеры мероприятия:

- Crypto Valley Association - самая влиятельная негосударственная организация по внедрению блокчейн-инноваций и регулированию крипто-рынка в Швейцарии.

- RU TALKS - ведущий деловой клуб России.

Источник: https://mostpp.info/crypto_sw_rf

ОБ ОСПАРИВАНИИ РЕШЕНИЙ ПО ОТКАЗУ В ПРОВЕДЕНИИ ОПЕРАЦИИ ФИНАНСОВЫМИ ОРГАНИЗАЦИЯМИ

Оспаривать решение по отказу финансовой организации сложнее, чем осуществить проверку контрагента или адреса криптокошелька.

Росфинмониторинг 14.09.2021 опубликовал информационное сообщение для лиц, которым было отказано в проведении операции, заключении договора банковского счета (вклада) либо договор банковского счета (вклада) был расторгнут в соответствии с требованиями пунктов 5.2 И 11 статьи 7 ФЗ №115-ФЗ.

В сообщение обращено внимание на то, что Росфинмониторинг не представляет клиентам финансовых организаций сведения о принятых в отношении них решениях об отказе или расторжении. Необходимо обращаться в финансовую организацию, в которой клиент обслуживается (обслуживался).

Дополнительно Росфинмониторинг рекомендует обратиться при взаимодействии к Информационному письму Федеральной службы по финансовому мониторингу 30 июля 2018 г. № 55 «О применении отдельных норм Федерального закона от 07.08.2001 № 115-ФЗ «О противодействии легализации (отмыванию) доходов, полученных преступным путем, и финансированию терроризма» в части функционирования механизма «реабилитации» клиентов, в отношении которых принято решение об отказе в обслуживании», и Методическими рекомендациями для предпринимателя 2.0 «Что делать, если банк ограничил операции по счету?», в которых даны разъяснения о возможных действиях для предотвращения применения кредитными организациями мер по отказу.

В нашей практике есть положительный опыт разблокировки банковского счета после предоставления заключения специалистов и даче пояснений по операциям.

ПРОШЛА ДЕВЯТАЯ ЛЕТНЯЯ ШКОЛА CTF 2021

C 30 июля по 9 августа 2021 года в шале-отеле «Таежные дачи» в Звенигороде прошла очередная традиционная Летняя школа CTF. В течение 11 дней участники прошли курс, состоящий из ежедневных лекций от экспертов в области информационной безопасности, представителей крупных IT-компаний и участников топовых CTF-команд. Лекционный материал сопровождался ежедневной практикой с решением разных типов задач по программированию и ИБ. По вечерам после учебы – отдых или развлекательные мероприятия от организаторов.

Организация мероприятия проходила следующим образом: до начала Летней школы участники прошли тест для определения уровня знаний. По результатам теста организаторы распределили участников по командам, во главе которых назначили кураторов. Всего было 12 команд, состоящих из учеников с разным уровнем знаний.

В этому году Летнюю школу посетило 87 участников из разных регионов России и СНГ, таких как: ЦФО, ДВО, Санкт-Петербург, Екатеринбург, Новосибирск, Ярославль, Сургут, Воронеж, Донецк, Таганрог, Томск, Пенза, Магнитогорск, Петрозаводск, Снежинск, Краснознаменск.

«Как организаторы, мы старались сделать так, чтобы ученики на Летней школе получали не только полезные технические знания, но и как можно больше знакомились и общались друг с другом, потому что командная работа и умение находить общий язык крайне важная составляющая успешной CTF-команды и полезный навык для любого специалиста. Для этого мы делали досуговые командные активности с рандомным распределением и по тому же принципу расселяли участников по номерам», – так описала свой подход к Летней школе команда организаторов.

Лекции на Летней школе читали представители таких компаний, как: ServicePipe, Лаборатория Касперскоrо, Код Безопасности, ЦФТ, НКЦКИ, издательство Хакер.ру, КриптоПРО, Group-IB, Инфорус, Cisco, Сбер, SearchInform, Актив-софт, ОМП, PassWare, Digital Security, ООО «Сеть Партнерств», Security Intelligence Cryptocurrencies Platform, Хакердом, Ассоциация руководителей служб информационной безопасности (АРСИБ) и другие.

Практическая часть состояла из ежедневных тасков, лабораторных на проведение тестирования на проникновение, лабораторной работы по компьютерным сетям и системному администрированию, хакатона «Сервис поиска фишинговых сайтов», тренировки Attack-Defense от команды Хакердом и AntiCTF, где участникам предстояло написать свои собственные таски, которые после проверки и модерации от технической группы давались для решения другим участникам. Также в один из дней проводилась секция от Георгия Кигурадзе для учеников с продвинутым уровнем знаний в обратной разработке. Чтобы попасть на секцию, участникам необходимо было пройти дополнительный отбор перед началом Школы.

За решение практики участникам начислялись баллы в два зачета: командный и индивидуальный. В конце Летней школы команды и участники, набравшие наибольшее количество баллов, награждались призами от спонсоров.

Досуговые мероприятия состояли из, караоке, спортивных игр, игр «Что? Где? Когда?», «Своя игра» и «Угадай мелодию», фестиваля красок Холи и прощального костра с «обнимашками». Дополнительной досуговой активностью стала игра «Киллер», цель которой – познакомиться с как можно большим количеством людей и придумать тактику игры, чтобы получить информацию для выполнения задания.

В последний день прошел фестиваль красок «Холли» и флешмоб «День Российского флага».

Финальное мероприятие Летней Школы – прощальный костер и «Обнимашки», флешмоб, на котором участники говорили друг другу теплые слова и повязывали памятную ниточку на специальное ожерелье. В последний день прошло официальное закрытие смены, награждение участников по итогам успеваемости и обед с праздничным тортом.

Источник: Всё о CTF в России

ИЗМЕНЕНИЕ ПОДХОДА К ОЦЕНКЕ РИСКА КОМПАНИЙ ПО АНТИОТМЫВОЧНОМУ ЗАКОНУ И БЛОКИРОВКЕ СЧЕТОВ

Знание и сила: с банков снимут ответственность за блокировку счетов. Какие новшества появились и какие несостыковки сохранились в версии законопроекта ко второму чтению?

В России изменят подход к оценке риска компаний по «антиотмывочному» закону и блокировке счетов. Сейчас решение принимает банк. Новая версия законопроекта о платформе «Знай своего клиента» де-факто наделяет кредитные организации правом полностью опираться на оценку юрлиц и ИП со стороны ЦБ. В то же время в крупнейших банках изъявили обеспокоенность, что в законопроекте сохранилась ключевая несостыковка с Гражданским кодексом ― он предусматривает отказ в выдаче денежных средств высокорисковым клиентам при закрытии их счета.

Решение за регулятором

Платформа «Знай своего клиента» (ЗСК), которая разрабатывается ЦБ, предполагает разделение юрлиц и ИП на три группы в соответствии с уровнем риска по «антиотмывочному закону». Она призвана повысить качество оценки подозрительных операций, защитить финансовый рынок от использования в противоправных целях и при этом сохранить беспрепятственные условия для добросовестного бизнеса, отмечается в новой рабочей версии законопроекта, которая подготовлена ко второму чтению.

Ранее, одна из основных претензий банковского сообщества к платформе ЗСК заключалась в распределении ответственности за блокировку операций и счетов, а также за отказ в их открытии. Предполагалось, что ЦБ будет направлять в банки информацию о надежности юрлиц и ИП, которой те фактически обязаны следовать. При этом в случае ошибки бизнес будет предъявлять претензии или даже подавать в суд непосредственно на банк. То есть решение об отнесении клиента к высокорисковой зоне будет принимать регулятор, а нести ответственность придется кредитной организации, сообщал ранее вице-президент Ассоциации банков России Алексей Войлуков.

В соответствии с новой версией законопроекта, разрабатываемый Банком России механизм не обязателен для использования кредитными организациями: они могут продолжать применять свои комплаенс-системы, напомнил один из авторов законопроекта, глава комитета Госдумы по финрынку Анатолий Аксаков. Однако он подчеркнул, что если банки применяют платформу ЗСК в качестве источника данных, то они не будут нести ответственность в случаях, когда их оценка не совпала с данными регулятора.

Если они опираются на информацию ЦБ и работают в соответствии с этой информацией, то у них ответственности не будет, ― сообщил Анатолий Аксаков. Также он подтвердил: если банки опираются на платформу, то они смогут использовать ее в качестве единственного источника данных.

ЦБ обладает большей платежной информацией: банк видит только часть цепи операций, а регулятор имеет возможность проследить ее от начала и до конца, сообщила начальник департамента финансового мониторинга Банка «Зенит» Людмила Соколова. Впрочем, она добавила, что кредитная организация в ряде случаев может доказать чистоту операций клиента посредством проведения глубокого анализа документов и деятельности, в то время как ЦБ не обладает документами по сделке/по операции.

В тех случаях, когда оценка риска клиента со стороны Банка России будет более консервативной, кредитные организации предпочтут полагаться именно на нее, ожидает директор по комплаенсу Ак Барс Банка Айдар Багавиев. Он подчеркнул: при этом важно, чтобы банки не забывали о собственной аналитике и не следовали слепо за позицией регулятора. Вполне возможны ситуации, когда критически важной информацией для целей борьбы с отмыванием денег будет обладать только кредитная организация, подчеркнул эксперт.

С учетом практики оспаривания мнения регулятора по ряду вопросов, кредитные организации пойдут наиболее простым путем, взяв за ориентир информацию и степени (уровни) риска, присвоенные клиенту Банком России, ожидает судебный эксперт, преподаватель Moscow Digital School Наталья Мануйлова.

Несостыковки есть

Ключевые изменения в сравнении с прежней редакций законопроекта заключаются в возможности банков обновлять сведения о клиентах с низким уровнем риска раз в три года, если отсутствуют подозрения в недостоверных данных, отметил директор по финансовому мониторингу и комплаенсу Росбанка Александр Попов. Он напомнил, что сейчас этот срок составляет год вне зависимости от уровня риска. В то же время сохраняется противоречие между нормой ст. 859 ГК, которой не предусмотрено право отказывать в выдаче денежных средств при закрытии счета, и нормой законопроекта, предписывающей отказывать в выдаче средств при закрытии счета высокорисковым клиентам, ― подчеркнул Александр Попов.

Новой редакцией запрещаются переводы при проведении проверок относительно легальности доходов, но при этом допускаются размещения средств, вкладов, выплаты зарплат как в банке, открывшем счет, так и в сторонних организациях, отметил ведущий юрист компании «Парфенон» Павел Уткин.

По его мнению, важной особенностью платформы ЗСК выступает то, что она охватывает только действия юрлиц, при этом не затрагивает проведение операций госорганами: таким образом законодатель автоматически констатирует, что отмывать деньги государственные структуры не могут и/или не будут. По предположениям эксперта, к госучреждениям будет применяться какая-то отдельная практика, которую обнародуют позже.

Платформа ЗСК станет своего рода бюро кредитных историй в рамках «антиотмывочного» закона, провел аналогию старший преподаватель кафедры банковского дела университета «Синергия» Дмитрий Ферапонтов: эта система администрируется регулятором, она централизована и выстроена в интересах рынка. В соответствии с новой версией законопроекта, за кредитными организациями остается роль сбора и анализа информации, поступающей по клиентам в соответствии с проводимыми ими операциями, а ЦБ выполняет задачу консолидации и обеспечения единого потока и доступа, заключил эксперт.

Ожидаются ответы на запросы от ЦБ и Росфинмониторинга...

Источник: Известия

RISKS OF PARTICIPATION IN HIGH PROFITABLE INVESTMENTS THROUGH CONTACTS IN SOCIAL MEDIA

SICP experts have identified another scammer using social media to cheat. Katrina Lucas from Los Angeles adds potential victims as friends on Facebook and starts a dialogue with them about cryptocurrencies and investments. She offers them up to 50% profit in the first week by investing her bitcoins in her services. The scammer mentions the cloud mining service Coincloudhashing, but this site is not available in the .com zone.

So, one of the scammer's wallets received 4 transactions worth 0.027 BTC. Subsequently, the funds were transferred to the consolidating wallet of the illegal service (in transit, with division into parts).

Associated with the profile is a bitcoin investment company page that leads to an inaccessible site in the domain zone in Nigeria (bitcoincom). From the information it follows that the illegal investment service allegedly charges $ 50,000 for 1 bitcoin. Here are trader Jennifer Smith's contacts and reviews of active users.

One of the wallets of the illegal service received 410 transactions in the amount of 5,669,312 BTC (over a period of about 3 months). It is linked to several other major wallets in the group in question.

The second scammer's wallet was launched a few days ago. Funds are withdrawn directly to the Huobi Global crypto exchange wallet. The wallet of the exchange user took 5 transactions for 0.034 BTC, which so far contain about 100 BTC. In total, the wallet received 14 785 129 BTC.

Katrina's Facebook page is currently unavailable, and messages from the correspondence have been deleted by the scammer (please take screenshots in advance). There are no active sites on the network.

Look before you jump!

Service: sicp.ueba.su

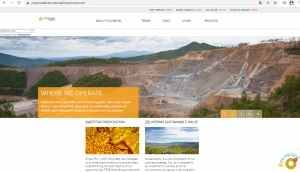

FRAUDERS USE NAME OF BIG PLAYERS

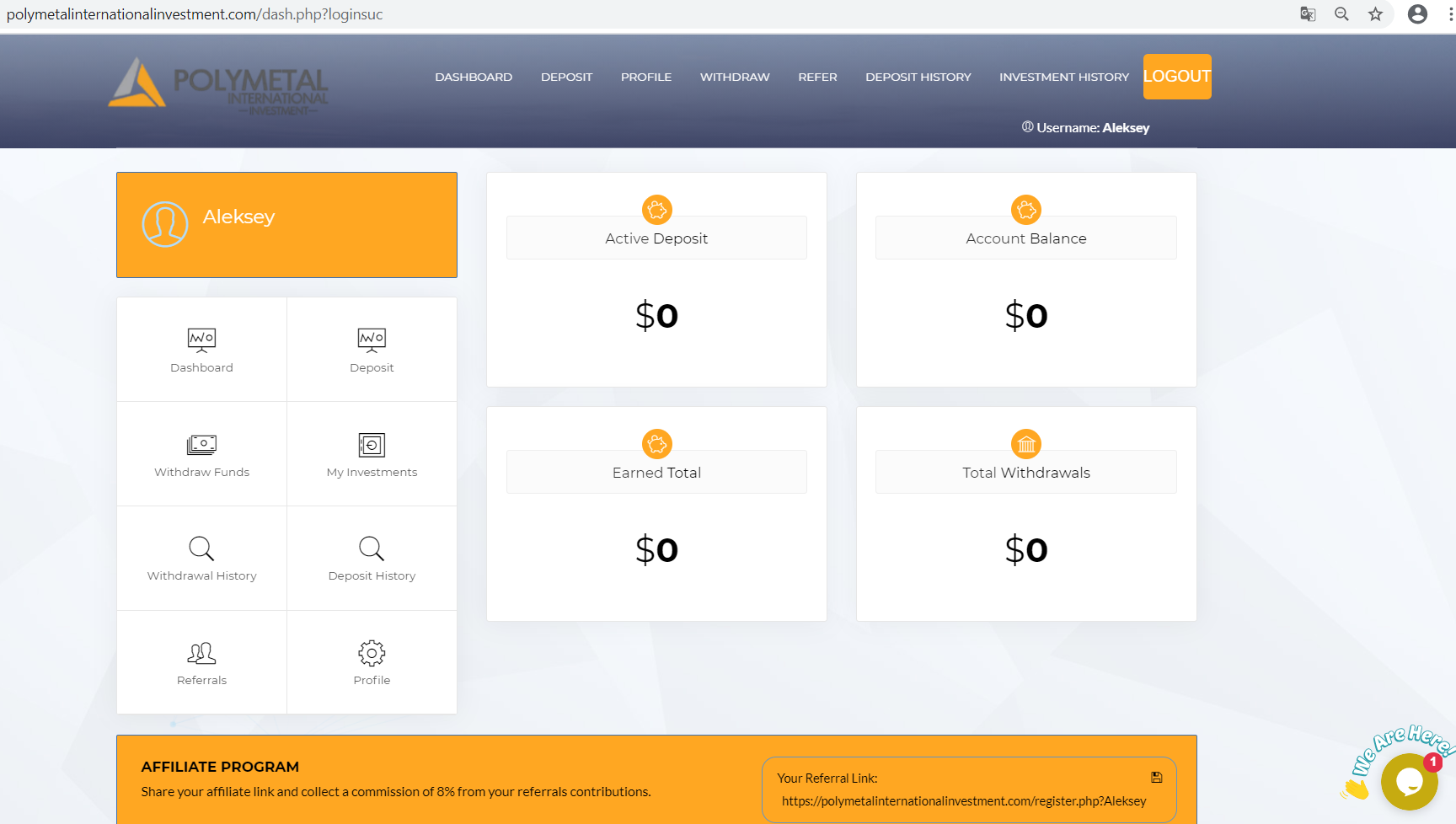

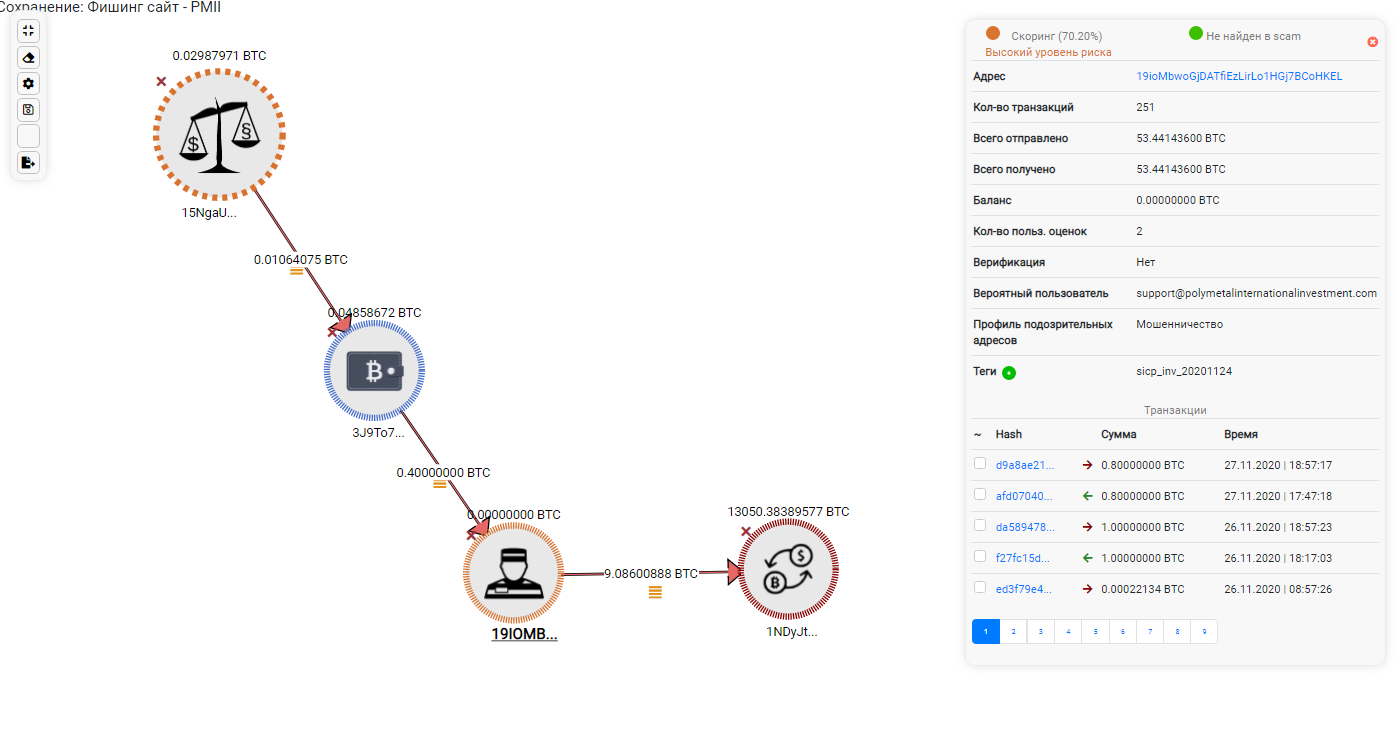

On November 2, 2020, the Polymetal international investment phishing site was launched. Its contents have been copied almost entirely from the original Polymetal International website. Most of the pages were copied and modified for the needs of the attackers. However, the link in the clone logo leads to the original site.

The home page of the fake site contains information about investment packages (5 types), with a profit of 5 to 50 percent in 8 days. The same information is available in the investor's personal account after registration. Investments can only be made in bitcoins.

In less than a month, the scammers sold 34 packages worth about 0.19 BTC. The criminals' consolidating crypto wallet received 250 transactions at 53.44 BTC. Most of the funds are withdrawn on the Hong Kong crypto exchange Binance.

It is noteworthy that on the same hosting in Phoenix (California, USA) there is another project of Lugwise Asset Management (Lugwiseinvest). The project was launched on October 5 and is positioned as a London-based asset management firm. Although the legal address on the site is listed in San Francisco (California, USA).

Judging by the activity and the amount of funds on the associated purses of the scammers, this is not a complete list of their illegal services and projects.

If you or your loved ones have suffered at the hands of fraudsters, please send notifications to the service mailbox of the CryptoCERT service (This email address is being protected from spambots. You need JavaScript enabled to view it.).

Original: Polymetal International

EXPERIMENTAL LEGAL REGIME FOR AI IN MOSCOW (BRIEF REVIEW OF THE LAW)

On April 24, 2020, Russian President Vladimir Putin signed the Law “On an experiment to establish special regulation in order to create the necessary conditions for the development and implementation of artificial intelligence technologies in the subject of the Russian Federation - the city of federal significance Moscow and amending Articles 6 and 10 of the Federal Law” About personal data.

Essentially brief:

- from July 1, 2020, over 5 years, an experiment will be conducted in Moscow to establish special regulation in order to create the necessary conditions for the development and implementation of artificial intelligence technologies in Moscow, as well as the subsequent possible use of the results of the application of artificial intelligence in other regions. At the end of the term, regulatory documents issued for the purpose of the experiment are canceled;

- in the Law for the realization of its goals the concept of “artificial intelligence”, as well as “artificial intelligence technology” is given;

- in order to establish an experimental legal regime (hereinafter referred to as the ELR), the Moscow Government will determine, inter alia, cases of mandatory application and (or) consideration of the results of the use of artificial intelligence in the activities of the Moscow Government, as well as the procedure and cases of transfer by owners of funds and photo and video surveillance of images obtained in accordance with the conditions provided for in subparagraphs 1 and 2 of paragraph 1 of Article 1521 of the Civil Code of the Russian Federation, as well as providing access to such media cameras and photo and video surveillance systems to state authorities and organizations performing public functions in accordance with regulatory legal acts of the Russian Federation. The list of organizations performing public functions is established by the Moscow Government;

- when making transactions and other legally significant actions, an ELR participant will be obliged to notify persons who are not participants in the experimental legal regime of his status as an ELR participant and indicate the application of the Moscow Government adopted in accordance with the Law in relation to his regulatory acts. if the legally significant actions specified in this part are committed using the Internet information and telecommunication network, the participant in the experimental legal regime inform the user (party to the transaction) of all applicable provisions of regulatory legal acts of the Government of Moscow adopted in accordance with the Law in question

- requirements for agreements between ELR participants and the authorized body (it is appointed by the Moscow Government), should provide mechanisms to ensure the confidentiality of the transmitted data and the security of their storage.

- (!) Personal data obtained as a result of depersonalization and processed in accordance with paragraph 6 of part 1 of Article 4 of the relevant Law cannot be transferred to persons who are not parties to the ELR. In the event that the ELR participant status is lost or the experiment is terminated after its expiration, the person who is the ELR participant loses the right to receive personal data obtained as a result of depersonalization and personal data stored in the form The result of such depersonalization is subject to destruction in the manner established by the authorized body by agreement with the authorized federal executive body, carrying out functions for the development and implementation of state policy and regulatory regulation in the field of information technology.

- for the destruction of personal data obtained as a result of depersonalization, in the prescribed manner, the procedure for assessing the conformity of information protection means, which include the function of information destruction, is carried out. The participants of the ELR are responsible for observing the rights of the subjects of personal data in accordance with the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data” for the entire duration of the experiment and after the termination of their participation in the experiment.

- during the experiment, it is not allowed to store personal data obtained as a result of depersonalization and processed on the basis of an agreement with the authorized body specified in paragraph 6 of part 1 of this article, outside the subject of the Russian Federation - the city of federal significance of Moscow.

- the status of an ELR participant is acquired from the moment it is included in the corresponding public register;

- the decision on inclusion or rejection is made by the authorized body (appointed by the Moscow Government) within a period of not more than thirty calendar days from the date of receipt of the application;

- The law provides requirements for the applicant, which, which can only be a legal entity or individual entrepreneur, registered in the territory of Moscow, as well as for the type of activity. The IP and the governing bodies of a legal entity have a requirement for the absence of an unexpunged or outstanding criminal record for crimes in the economic sphere, as well as for crimes of medium gravity, serious and especially serious crimes.

- the reasons for the refusal to be included in the register are prescribed in the Law (it seems to me quite common); in case of refusal to include in the register of ELR participants, the authorized body shall notify the applicant of this with a motivated justification for such a refusal.

- the reasons for the exclusion of the ELR participant from the register are also indicated, the exclusion is carried out within 10 working days.

- the formation of strategic directions and monitoring the activities of participants is planned to be entrusted to the ELR Coordination Council, which, on the proposal of the Government of the Russian Federation, includes representatives of federal executive bodies.

- Amendments to Article 6 and Article 10 of the Federal Law of 07.27.2006 No. 152-FZ "On Personal Data" in terms of processing conditions and in the processing of special personal data, respectively.

VIDEO CONFERENCE "DI DIGITAL IDENTITY"

Expert Natalia Manuylova invites to a video conference DI Digital Identity to discuss the topic of digital identification, a number of FATF documents. This is a test meeting. Only important points will be affected, without “water procedures”. Welcome! The number of free tickets is limited ...

At the online event, scheduled for April 23 (from 11:30 to 12:30), you can get answers to questions such as: What are some common examples of digital identification? Why does the FATF pay special attention to ID? FATF document overview. Lawyers, AML / CFT specialists and other interested parties are invited to participate.

Source: TimePad.ru

Search

Blog Category

Popular Post

Latest News

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su